The cryptocurrency ecosystem is extensive and encompasses several assets, including altcoins, shitcoins and other meme currencies. Each, however, is grouped under the giant umbrella of cryptocurrencies, yet each has different aims and features.

As an active participant in this area, I have encountered numerous queries dealing with those two categories. In this guide, I will analyze the differences between altcoins and meme coins and thus assist you in your crypto pursuits.

Key Takeaways

- Altcoins possess valuable features instead of meme coins, which are more of humour and speculation.

- Mysterious currencies are less valuable than their advanced counterparts because the real-world usefulness of altcoins is diverse.

- Further, even though meme coins are often speculative and highly volatile, assuming they will always be so is false. Altcoins will usually have a more stable value proposition.

- The concepts help us understand why some investing in altcoins are more attracted to the aspects of technology than those investors in meme coins who seek bubble profits.

- Investors are better positioned to take positions on both altcoins and meme coins after they have appreciated their respective features.

Introduction to Cryptocurrencies

To understand the difference between altcoins and meme coins, one must first understand some basics concerning cryptocurrencies. Cryptocurrency, or crypto for short, is a digital or virtual currency that employs cryptography for security purposes.

It is based on blockchain technology, a distributed ledger that tracks all transaction records over a network of computers.

- Bitcoin: ThBitcoin is the original and best-known crypto; .itcoin pioneered the idea behind blockchain technology but is also significant in the crypto arena.

- Blockchain Technology: A distributed architecture that maintains transparency, security, and non-repudiation over transactions.

What Are Altcoins?

Altcoins refers to alternative coins, which are any of the many cryptocurrencies except for the more popular Bitcoin.

These currencies are to supplement Bitcoin’s strengths or introduce new features.

The existence of altcoins has supplemented the utility of the cryptography ecosystem as they come in different structures.

Types of Altcoins

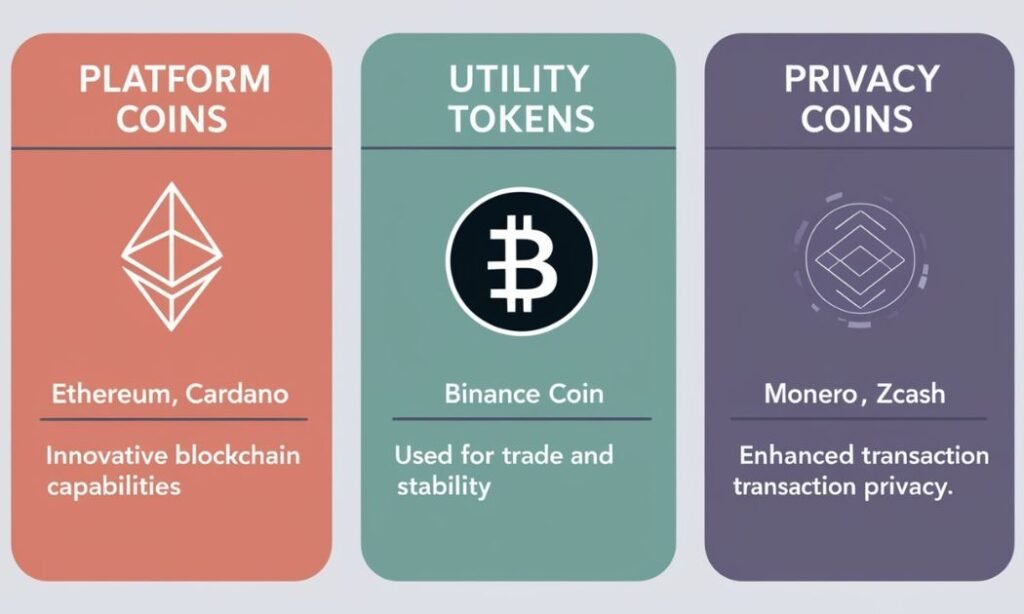

1- Platform Coins

These cryptocurrencies are the base layer of applications and services built on them. For example:

Ethereum has gained popularity due to its innovative contract capabilities, which enable developers to create dApps on its network.

Cardano: An initiative whose goal is to build a safe and more efficient blockchain architecture.

2- Utility Tokens

Tokens that can only be utilized in a limited number of platforms or environments. For example:

Binance Coin (BNB): When it was released, BNB’s initial purpose was to provide benefits on the Binance platform. Now, it is used to pay trade commissions and stake and attract funds by participating in token sales conducted on the Binance Launchpad.

Stablecoins: Their value is supported by state-supported bistability due to reserve worth real, precious things, such as fiat currency.

3- Tether (USDT) and USD Coin (USDC)

Privacy Coins: These coins aim to improve transaction features by making them transactional or non-disclosable.

Monero (XMR) and Zcash (ZEC) incorporate sophisticated encryption to make transaction information undetectable.

Key Features of Altcoins

- Use Case: Many altcoins, such as an innovative ontract platform, privacy, and decentralized finance (DeFi).

- Have been created for use cases. Technology: Most of them improve upon or take advantage of some novel technologies never used on the Bitcoin blockchain.

- Market Cap and Volatility: Some of the altcoins may have big market capitalizations and have been noted to be stable, while others can be very volatile and speculative.

Pros and cons

Pros of Altcoins

- Diverse Use Cases: Some functional, technology and finance altcoins like Ethereum and Ripple.

- Innovation: Pioneering new technologies or features of the blockchain.

- Potential for Growth: Severalltcoins also have a healthy chance of appreciation, making them investment prospects apart from Bitcoin.

- Enhanced Functionality: Offer more capabilities like intelligent contracts and dap embedding.

- Reduced Volatility: A few specific coins, known as stablecoins, are designed to be less volatile than the other cryptocurrencies.

Cons of Altcoins

- Market Saturation: The followers have to screen through thousands of altcoins to find gosuitablerojects.

- Regulatory Risks: Different regulations across jurisdictions may and have affected the valuation and acceptance of altcoins.

- Scams and Fraud: The market is filled with projects of a dubious nature.

- Technology Risks: Any young technology is always prone to vulnerabilities and problems when designing or executing.

- Liquidity Issues: Some altcoins are illiquid in the market because of particular trading volumes.

What Are Meme Coins?

This cryptocurrency category is based on internet memes that are often not serious.

As with other cryptocurrencies, there is no technical severe groundwork or purpose, but due to the nature of the marketing, there is a market, and there are people and interests.

Characteristics of Meme Coins

1- Origin: Meme coins usually start as humour, joke, or parodic plans. For example:

Dogecoin (DOGE): It started as a joke based on the Doge meme but gained quite a momentum, with people using it for tips and charitable purposes.

Shiba Inu (SHIB): In turn, this coin emerged because of Dogecoin’s digital fame, often known as the “Doge killer.” Pepe Coin: T is another cryptocurrency focused on meme culture, using the popular meme of Pepe the Frog.

2- Community-Driven: In the same vein, meme coins are usually marketed and traded off social media platforms, as their marketing strategies depend heavily on celebrity public interaction and endorsements.

3- Volatility: Classifying such tokens as meme coins always puts them in an unpredictable category since their worth is usually speculative and often affected by market hype.

Popular Meme Coins

Dogecoin (DOGE): Originally created to make fun of some of the more popular coins, DOGE has taken the market by storm today thanks to a very active community and numerous celebrities.

Shiba Inu (SHIB): Shiba Inu gained fame as a meme coin with a growing community and some vigorous tokenomics aiming to repeat grassroots success and that of a tremendous or without any critical mass.

Pros and Cons

Pros of Meme Coins:

- Community Engagement: The community plays a significant role in promoting and increasing the holding of the coin.

- Low Entry Cost: These are sold meagerly and can attract new investors.

- Viral Potential: This includes how such coins are propagated and get support quickly.

- High Volatility: The potential to earn profits within a short period due to the increase in price fortuitously.

- Speculative Opportunities: Appeals to speculators looking for revenge on trading some assets.

Cons of Meme Coins:

- Speculative Nature: More often than not, little technology and real-world applications are focused on.

- High Volatility: As much as this volatility leads to profits, it also poses the danger of losses to the investors.

- Lack of Regulation: More open to abuse by the market and schemes such as pumps and dumps.

- Limited Utility: They usually have no concrete and practical technical improvements.

- Short-Lived Trends: There are potbellied trends which die very quickly.

Critical Differences Between Altcoins and Meme Coins

1. Purpose and Use Case:

Altcoins: These are usually created with a clear goal or innovative technology. The link is on purpose as Ethereum activates “smart” networks”s, which the privacy-focused coins like Monero ensure detailed transaction privacy.

Meme Coins: These coins do not present real-life problems and are mostly made as a joke or for entertainment. They are virtually worthless and can only increase in value because of the community members and the media coverage.

2. Technology and Development:

Altcoins usually possess such characteristics and development teams, which aim at solving some problems in reality or at developing some outstanding technologies for blockchains; thus, the market competition is strong.

Meme Coins often have little harmonic technological improvement, are based on generic ideas, and are often implemented by people or small organizations with no development force.

3. Market Behavior and Volatility:

Altcoins: In terms of stability, there is always a range of activity levels among these types of altcoins in the market. For example, mature altcoins that go along with their main suggested applications will have tough investment behaviour.

Meme Coins: Their prices are overly fluctuating, and they run and dive at lightning speed depending on the market trend, social media, or price speculation.

4. Community and Support:

Altcoins: Always have support groups for the application or layout of the coin technology. For example, some coins may support business and institutional collaboration.

Meme Coins: Rely heavily on social media and internet communities for support. This type of currency value can be particularly volatile and heavily depends on specific online trends and influencer trends

5. Investment Potential:

Altcoins: However, they are regarded as the most civilized and secure type of exchange with investment potential because the technological base and practical application mainly keep it long-term.

Meme Coins: Very often, these ‘watch the fluctuations in the bottom of the pit’ can be considered high-risk. Due to the high risk, many discounts, however, do not have a cut-off high potential of losses.

Real-World Applications and Future Prospects

Altcoins

- Use Cases: A number of altcoins can cater to real-world needs, such as carrying out payments, hosting decentralized platforms, etc., or offering privacy benefits.

- Future Prospects: Altcoins with solid technological backgrounds and clear use cases will be the future of blockchain technology and will noticeably develop across the market.

Meme Coins

- Use Cases: There are usually no real-world use cases apart from being an investment guessing game or a community-driven project.

- Future Prospects: The prediction for this category of cryptocurrencies appears to be quite hazy and subject to the nature of the market, level of community participation, and general attitudes towards cryptocurrencies.

My Opinion

There are two categories of coins in the blockchain domain, strong defenders of which are altcoins and Meme coins skeletons sufficiently well defined cryptographers speculation or creative mix. Such altcoins are the kinds of alternatives and supportive cryptocurrencies that stem from the stable technology and a defined set of the target user.

However, meme coins are nonsensical assets which are made as a joke or basically for fun, and its worth is dependent on the fandom and social media usage.

It is necessary to learn about these distinctions as they will make your investment decisions and further actions more substantial in the crypto market and ecosystem.

Whether interested in altcoins’ technological trends or looking to earn with meme coins, relevant knowledge of these traits and their market performances is a prerequisite to operating in the sphere of cryptocurrencies.